Small Business Line of Credit vs. Credit Card: Who Wins?

Small Business Line of Credit. vs Credit Card

Chello’s Two Cents: “While a line of credit tends to provide the flexibility similar to a credit card, you will typically find with a line of credit that there is greater access to a larger amount of capital. Credit cards tend to be for smaller point of sale type purchases whereas lines of credit can allow for larger expenses that may pop up over the course of running a business.”

There’s no doubt that somewhere along the lines of owning a private medical practice, you are going to need to make use of a financing tool to assist with medical endeavors. Sudden expenses, cash flow needs, or major purchases could all arise and prompt you to look for immediate access to funds.

With all the layers of the healthcare industry, it’s important to weigh the pros and cons of each tool to see what would better serve your practice’s specific needs at that moment of time as well as in the future. Two ever-popular choices that are always top-of-mind of any small business needing quick funding are the business line of credit and the business credit card. They are similar in many regards, mainly that they are both flexible forms of funding with access to revolving credit lines, but they have distinct differences that may cater to this sort or that sort of doctor. It’s important to not just choose either (or both) without due consideration and seeing what aligns best with your scenario.

How Does a Business Line of Credit Work? And What Is It?

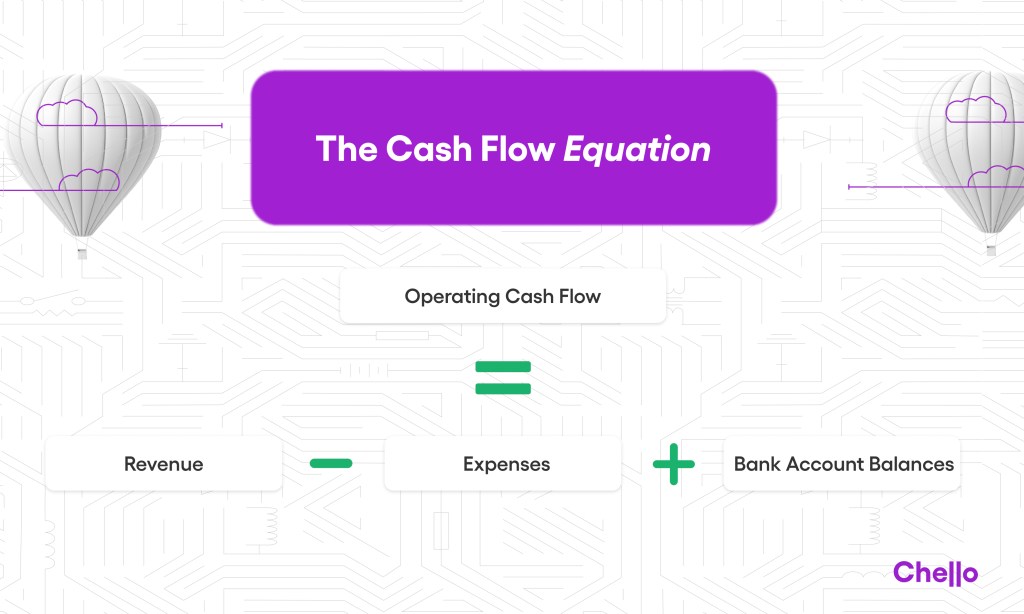

A business line of credit is a financing option that offers businesses the flexibility to borrow funds up to a predetermined credit limit. They normally cap out between $250,000 and $500,000. You only pay interest on the money you are actually using and not the entire credit line. It is unlike a traditional loan where you’d be handed a lump sum of money that you’d pay back with interest through scheduled monthly payments.

For a line of credit, the business can access funds as needed, up to the credit limit. Every time the business repays off what they borrowed, they then have the option to borrow again. It’s revolving.

A line of credit allows doctors, practice owners, or any type of small business owner to manage cash flow fluctuations and cover unexpected expenses. Repayment terms vary, but businesses typically make regular payments (for Chello’s line of credit, those are weekly) to repay the borrowed amount along with accrued interest and fees. Many of those who opt for a line of credit go into it knowing that they will need ample time to pay back what they’ve used.

A business line of credit is a valuable financial tool for private medical practices, offering flexibility and liquidity to manage finances effectively and navigate the challenges of the healthcare industry.

Advantages of a Line of Credit:

- Adaptability: Private Practice owners can withdraw and repay funds as required within their credit limit, enabling them to manage their finances effectively. A line of credit keeps you from withdrawing funds that you most likely won’t use. Unlike a term loan, you don’t have to use the whole amount of credit.

- Interest Rates: A big perk to getting approved for a line of credit is that you will most likely have a higher spending limit than a credit card.

- Immediate Access: There isn’t much wait time involved before you have access to funding. It’s on-demand money and it’s especially fast if powered online.

- Routine Payment Schedule: This will force doctors to keep a closer tab on their finances and ensure that you are making progress towards their goal of repayment. It also, at base level, provides peace of mind.

Disadvantages:

- Approval Process: As the credit available is most likely higher, the approval process might take a bit longer.

- Credit Score Damage: Although these cards can help build credit history, they can just as easily tear them down. Misuse can affect your credit score greatly.

Instances Where a Doctor Would Use a Line of Credit

- Procuring fresh supplies

- Financing needs associated with an expansion or merger

- Launching an additional practice

- Addressing cash flow lulls during quieter periods

- Upgrading or replacing equipment

- Any other purchase with a high up-front cost

How Does a Business Credit Card Work? And What Is It?

A small business credit card is very similar to a personal credit card but instead supports the needs of small business owners and helps keep business spending completely separate from personal spending. Small business credit cards are a physical item that provide credit that can be used to buy anything your business needs, most likely those will be smaller purchases or routine, fixed expenses.

You simply charge purchases on your business credit card using the credit that is attached to that card and then at the end of each billing cycle, receive a list of all of your charges, and your total amount due. If you pay your amount in full, then there will be no associated interest. Bonus: many small business credit cards offer rewards or cash back that can come in handy down the road.

Advantages of a Business Credit Card

- Bonuses: These cards tend to offer strong sign-up bonuses, also known as welcome fees as well as many business-related perks like service discounts.

- Interest-Free Periods: Many credit cards offer extended periods of interest-free financing.

Disadvantages of a Business Credit Card

- Credit Score Damage: Although these cards can help build credit history, they can just as easily tear them down. Misuse can affect your credit score greatly.

- Annual Fees: There’s an opportunity for hidden fees as well as expensive annual fee depending on which card you go with.

- Risk of Overspending: As with any form of credit, there’s an opportunity to overspend if you aren’t paying close attention to what you are charging.

Instances Where a Doctor Would Use a Business Credit Card

- For an immediate purchase

- Routine expenses like office supplies

- Travel expenses

- Emergency situations

How Does a Business Line of Credit Stack Up Against a Credit Card?

Although these two forms of funding are both a convenient way to pay for essential business needs there are a few aspects that pertain to each that you need to keep in mind.

A small business line of credit is a better choice for higher spending needs, when a credit card may not be an accepted form of payment, and offers a lot of flexibility. It’s great for cash flow management while a business credit card is better suited to expenses you can pay off in the short-term and have built-in business perks, if that is of value to you.

The best option for you ultimately depends on WHAT you are needing the funding for and WHERE you see your practice headed in the long run.

In the end, business lines of credit and business credit cards are compatible products. Once you understand the differences between them, you can decide which one is best for your business needs.It’s also important to consider what actually your industry is. For a doctor, for example, a line of credit makes most sense as their purchases and funding needs are often for large items.

There is also a possibility that both of these methods work for you. Having both on hand can be best practice as it allows you more flexibility.

It’s important to consult with your business advisor or if you have remaining questions, reach out to us here at Chello.