How the right payer mix can help you manage cash flow

Secrets to the Right Payer Mix

Few factors wield as much influence over financial stability as payer mix. It is critical determinant of a provider's financial health. From Medicare and Medicaid to private insurers and self-pay patients, the composition of payment sources directly influences the cash flow dynamics of healthcare organizations.

By strategically managing this mix, providers can not only optimize revenue streams but also enhance financial stability and resilience in an ever-evolving healthcare ecosystem. Let's delve deeper into how understanding and actively shaping your payer mix can be a cornerstone in effective cash flow management strategies.

In this Article:

- What is Payer Mix?

- Best Ways to Improve Payer Mix

- How Do You Calculate Payer Mix?

- How the Right Payer Can Help Cash Flow

- What is the RIGHT Payer Mix?

- The Right Tools to Maximize Payer Mix

What is Payer Mix?

Payer mix in healthcare refers to the distribution or composition of different sources of payment that healthcare providers receive for their services. This typically includes payments from various entities such as government insurance programs (like Medicare and Medicaid), private insurance companies, self-pay patients, and other third-party payers.

Understanding the payer mix is crucial for healthcare providers as it influences their revenue streams, reimbursement rates, and overall financial stability. Shifts in the payer mix can have significant implications for healthcare organizations, affecting their profitability, resource allocation, and strategic planning.

Best Ways to Improve Payer Mix

Every doctor out there is always looking for the right solution to optimizing their payer mix. There may not be just one way of doing so but we have collected a few suggestions that are both tangible and concrete and can be implemented into your private practice straight away.

- Diversify Accepted Insurances: Expand the range of insurance plans accepted by the practice to include popular commercial insurers in the local market. This can attract a broader patient base and reduce reliance on a single payer source.

- Negotiate Higher Reimbursement Rates: Engage in negotiations with insurance companies to secure higher reimbursement rates for services rendered. Providing data on patient volume, quality of care, and outcomes can strengthen bargaining positions.

- Focus on Attracting Privately-Insured Patients: Implement marketing strategies targeted at attracting patients with private insurance coverage. This could involve advertising campaigns, networking with employers offering health benefits, or participating in community events to raise awareness of the practice among potential patients.

- Optimize Coding and Billing Processes: Ensure accurate and timely coding of medical services provided to maximize reimbursement rates. Train staff on proper coding practices, conduct regular audits to identify coding errors, and streamline billing processes to expedite claims submission and payment.

- Offer Cash-Pay Discounts: Encourage self-pay patients to choose the practice by offering discounts or flexible payment plans for services paid out-of-pocket. This can help mitigate the impact of uninsured or underinsured patients on the payer mix.

- Provide Value-Added Services: Differentiate the practice by offering value-added services that may not be covered by insurance but are attractive to patients. This could include telemedicine consultations, wellness programs, or enhanced patient education resources.

- Develop Referral Relationships: Cultivate strong referral relationships with other healthcare providers, specialists, and hospitals in the community. This can lead to a steady stream of patients with diverse payer sources and increase the practice's visibility and reputation.

- Monitor and Adjust Strategies: Continuously monitor payer mix trends and the effectiveness of implemented strategies. Analyze reimbursement data, patient demographics, and market dynamics to identify areas for improvement and adjust tactics accordingly.

By implementing these strategies, a doctor in private practice can actively work towards improving their payer mix, diversifying revenue streams, and enhancing the financial sustainability of the practice.

How Do You Calculate Payer Mix?

Calculating payer mix for a private practice involves analyzing the proportion of revenue generated from different sources of payment. Here's a general process:

- Gather Revenue Data: Collect financial data on all payments received by the practice over a specific period, typically monthly or annually. This includes payments from various sources such as insurance companies, government programs (e.g., Medicare, Medicaid), self-pay patients, and other third-party payers.

- Categorize Payments: Classify each payment according to its payer source. For example, separate payments received from Medicare, Medicaid, private insurance, self-pay patients, and any other relevant categories.

- Calculate Total Revenue: Sum up the total revenue generated by the practice during the specified period.

- Determine Proportions: Calculate the percentage or proportion of revenue contributed by each payer source. This is done by dividing the total revenue from each payer category by the total overall revenue and multiplying by 100 to get the percentage.

- Analyze the Payer Mix: Review the calculated percentages to understand the practice's payer mix. Identify the primary sources of revenue and their respective contributions to the overall financial picture.

- Monitor Trends: Regularly track changes in the payer mix over time to identify any shifts or trends. This information can help the practice anticipate financial challenges or opportunities and adjust strategies accordingly.

- Use Data for Decision-Making: Utilize insights gained from analyzing the payer mix to inform decision-making processes related to contracting with insurance providers, setting pricing strategies, improving billing and collections processes, and optimizing revenue cycle management.

How the Right Payer Mix Can Help Manage Cash Flow

Your practice’s payer mix is vital because it affects when and how much you will be paid by each player in the payment ecosystem. In addition, it's no secret that having a healthy and stable cash flow keeps your practice running smoothly.

So, what do you need to know and what can you do to ensure you have the right payer mix for your practice alongside a happy, positive cash flow?

Let’s explore a scenario: if two patients with different insurance payers come to your practice for the same exact procedure, as you probably know by now, you may get paid different amounts at different times. Without the right tools, this inconsistency and unpredictability can largely affect your practice's cash flow.

To get a wrangle on this, as a practice owner, it's essential to manage and track who your patients are, what kind of insurance they have, and what treatments you provide most often – with the goal of getting to a place where you can optimize your revenue cycle processes automatically.

Consider the following:

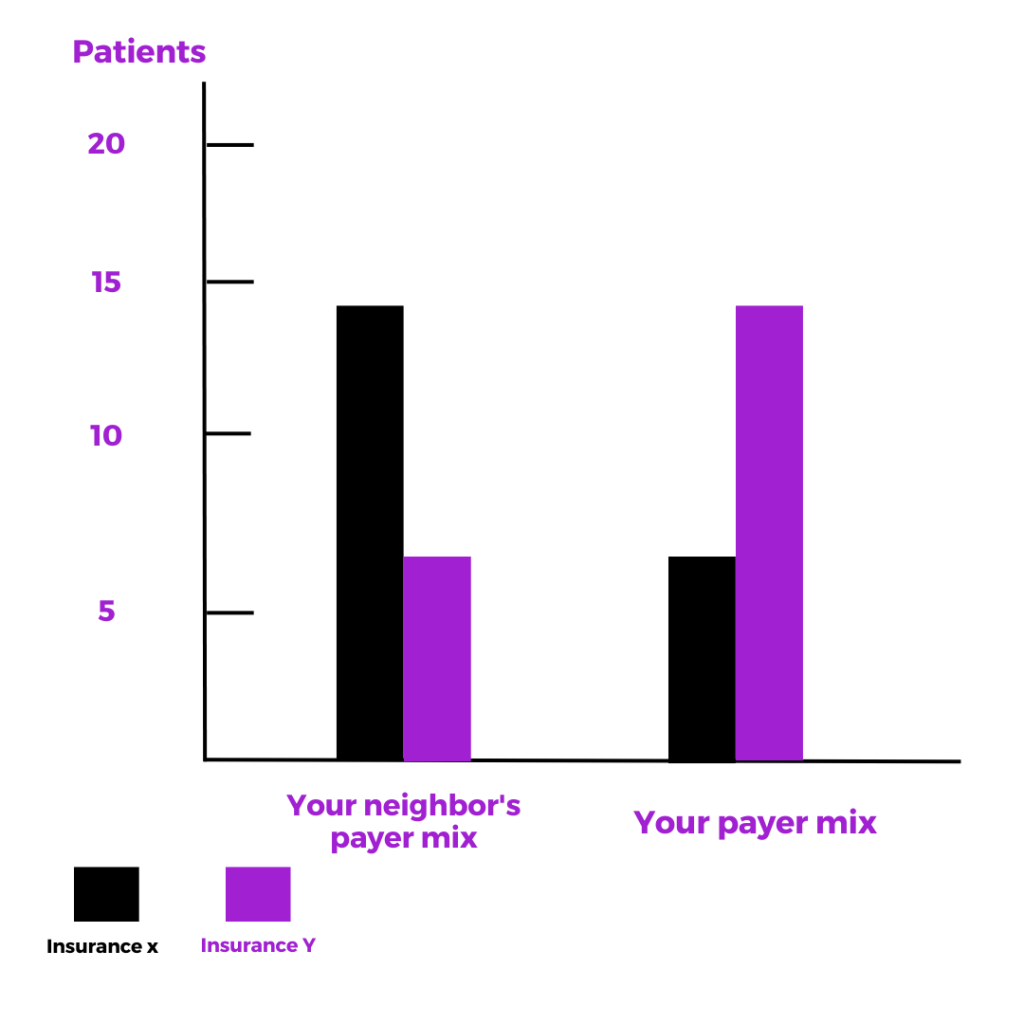

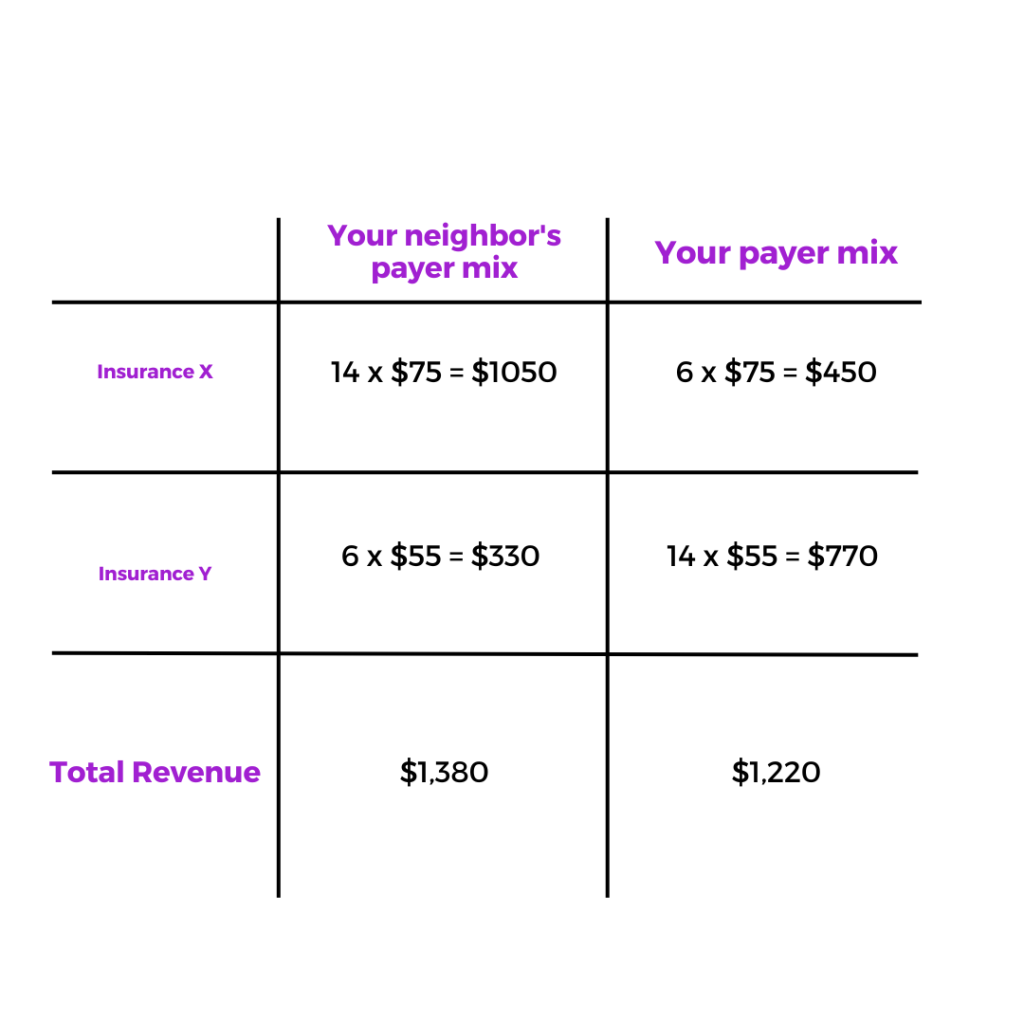

20 patients visit your practice, and 20 different patients visit a neighboring practice for the same treatment. For this example, let's assume both practices charge the same amount and spend equal resources and time on each patient. The only difference in the equation is the individual practice's payer mix.

Insurance X pays more for this treatment at $75, while insurance Y only pays $55. As a result, your bottom line will be different.

While a slight difference above, the impact of this payer mix difference over a year (254 weekdays) can better showcase the difference in revenue. Your neighbor is bringing in 13% more for the same exact procedure.

Your practice's annual revenue from this example would be $309,880, while your neighbors would be $350,520. This results in a difference of $40,640 per year for performing the same procedure. So yes, the payer mix matters – a lot! Let's dig in a bit.

What's the right payer mix?

There is no one size fits all. Your optimal payer mix depends on several factors, including, but not limited to, your specialty, type of payer (i.e. Medicare, Medicaid, private insurance), how much risk you are willing to take, your geographic area, referral sources, and patient demographics. Therefore, when determining your payer mix, it is essential to keep these factors and a host of others in mind to optimize your practice best.

Understanding how much each type of payer reimburses for each CPT (Current Procedural Terminology) code is vital. CPT codes are a uniform language used to report medical services to health insurance companies. While the codes are constant, each type of insurance will reimburse differently per code. For example, you can find the reimbursement rate for Medicare by using the Medicare Fee Schedule. For Medicaid, you use your state's rate and fee schedules, and private insurance reimbursement rates will vary depending on the provider.

Ultimately it comes down to your ability to understand how shifts and changes affect your revenue and your cash flow, so you can proactively plan and mitigate any risk of surprises… this comes down to having the right tools at your fingertips.

The Right Tools to Maximize Payer Mix

Even with all these efforts to create the perfect payer mix, ultimately, you are still relying on a third party, and it can feel as though ensuring consistent cash flow for your practice is out of your hands. But if you have the right tools, you can minimize the impact of uncertainty. This where Chello comes in.

Chello takes the mystery of not knowing what the future holds out of the equation and gives you more visibility into when you will be paid and from what source, significantly lessening the stress about perfecting your payer mix and even helping you manage it. We do this by leveraging insights from your practice's flow of claims and payments to power monthly cash-flow predictions and payer mix story snapshots that you can share with your team. And, if you ever get low on cash or simply want to invest more in your practice, you can access quick and convenient funding through Chello's Boost Funding Engine*.

Understanding your payer mix is essential for your practice, but it shouldn't remove your focus from what truly matters: helping patients. Remember, there isn't a single magical mix: you should try to find the right balance for your practice depending on your specialty and the type of patients you have. But don't make it hard on yourself!

Instead, let Chello give you the transparency you need to focus on what you do best.

*Subject to credit approval. Terms and conditions may apply. Chello is a division of Oriental Bank.