How Revenue Cycle Management Drives Financial Success in Healthcare

How Revenue Cycle Management Drives Financial Success in Healthcare

Efficient revenue cycle management (RCM) is the backbone of any medical practice’s financial stability. When operational inefficiencies—such as missed claims, coding errors, or billing issues—occur, they can disrupt cash flow, causing payment delays and adding to the administrative workload. One study found that claim denial costs hospitals roughly $262 billion annually, with denial rates as high as 10%.

Whether you operate a doctor’s office, eye care clinic, or dental practice, managing your revenue cycle prevents delays and supports timely reimbursements. Explore why RCM matters for your practice and how Chello can help improve cash flow management.

Revenue Cycle Management for Healthcare Practices: An Overview

RCM is the basis of your healthcare practice’s financial operations. It covers everything from checking a patient’s insurance to ensuring you get paid after providing services. Here’s an overview of RCM tasks for healthcare businesses:

| RCM Stage | Description |

| Patient Intake & Scheduling | The front office collects patient information, verifies insurance, and secures pre-authorizations to avoid billing issues. |

| Charge Capture & Coding | Providers document services rendered, and coders translate those into standardized codes (ICD-10, CPT) for billing and reimbursement purposes. |

| Claims Submission & Payment Posting | Billing staff submits claims to insurers, tracks the progress, and posts payments, addressing discrepancies or underpayments. |

| Denial Management | Billing or administrative teams review denied claims, investigate the reasons, and work on corrections or appeals to recover lost revenue. |

| Patient Collections | Staff follows up on patient balances, collecting co-pays and fees not covered by insurance. |

Why Is Revenue Cycle Management Essential for Maximizing Profitability?

Your practice’s RCM processes directly impact cash flow and overall financial health. Many healthcare organizations face challenges with revenue management due to regulatory changes such as coding updates and claim denials. When these issues disrupt cash flow, they can lead to operational limitations and budget constraints, which may reduce the quality of patient care due to strained resources or delayed services.

Without effective management, revenue can easily become tied up in unpaid claims, slow reimbursements, and uncollected patient balances. These cash flow issues may delay essential expenses like payroll, equipment costs, or loan payments, potentially affecting your practice’s financial stability.

Effective RCM ensures that claims are tracked and managed to maintain steady payments, which helps prevent cash flow gaps. Your practice can stay financially stable by accurately processing claims and collecting patient balances within the recommended 90-day window. This ensures you have funds to cover essential operational costs like salaries, EHR software subscriptions, and office supplies, keeping your practice running smoothly.

It also helps you allocate medical practice funding in areas that need it, allowing you to invest in improvements, hire staff, or update equipment without worrying about revenue shortfalls.

How To Streamline Your Revenue Cycle Management Process

Streamlining your revenue cycle management can reduce delays and keep cash flowing. Here are a few tips for boosting your RCM and improving your overall financial processes:

- Train staff on claim submissions. Train your staff to use the correct medical codes for your specialty and hold regular workshops to keep their skills sharp. Provide easy access to updated coding resources to help your team avoid submission errors, speed up the claims process, and minimize payment delays.

- Check daily cash flow. Review daily cash flow reports to identify inconsistencies or shortfalls. Adjust as needed to keep your finances on track and avoid last-minute issues with payments or expenses.

- Set a practice-wide budget. This budget should include weekly and monthly payments, such as medical business loans and equipment costs. Regularly compare your actual cash flow to your budget to ensure you cover essential expenses while planning for future growth.

- Fix denials immediately. Private insurers deny up to 15% of initial claims from healthcare providers, reducing available cash flow. When a claim gets denied, assign someone on your team to investigate and correct the issue. Don’t let denials pile up—resolving them promptly helps you recover lost revenue faster.

Use cash flow projection tools. Implement tools that calculate daily cash flow scores and provide 3-month financial forecasts. These tools send you alerts if you’re projected to fall short, giving you time to make data-driven financial decisions and protect your business from cash flow problems.

Chello: Your Real-Time Revenue Cycle Management Tool

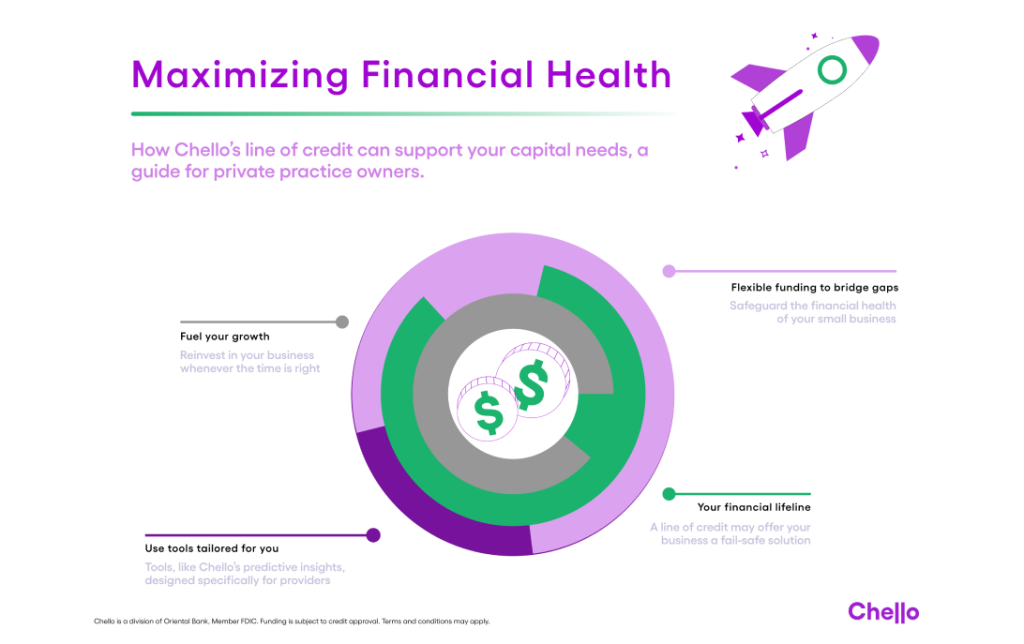

Once you’ve improved your RCM, how do you maintain cash flow stability? Chello offers an advanced analytics platform with built-in Cash Flow Projection features that give clear, actionable financial insights. It seamlessly integrates with your banking, accounting, and healthcare software, providing a complete view of your practice’s fiscal health.

With daily cash flow scores and 90-day forward projections, it tracks real-time data and helps you anticipate potential shortfalls. You’ll see all your critical information—like deposits and payments—on a single dashboard, including when payments land in your account. If cash flow dips, you can access your healthcare practice loan through Chello’s Boost Line of Credit, which provides the financial flexibility you need to stay on track. These tools allow you to make data-based financial decisions, reinvest wisely, and keep your practice thriving.

Manage Your Healthcare Revenue Cycle With Chello

A well-managed revenue cycle helps maintain a steady cash flow and supports your practice’s financial well-being. Addressing challenges like claim denials and missed payments can prevent cash flow issues that affect your ability to invest in critical areas.

Tools like Chello provide valuable insights into your daily financial operations, helping you anticipate potential shortfalls and make data-informed decisions.

Take control of your revenue cycle and support steady growth with Chello. Sign up today to apply for a medical practice business loan and get all the benefits of our analytics platform.