How Chello Supports Practice Management Systems To Boost Financial Health

Practice management systems (PMS) are essential tools for modern healthcare, driving scheduling, billing, and records efficiency. Nearly 78% of office-based physicians now use certified electronic health record (EHR) platforms, more than double the number a decade ago.

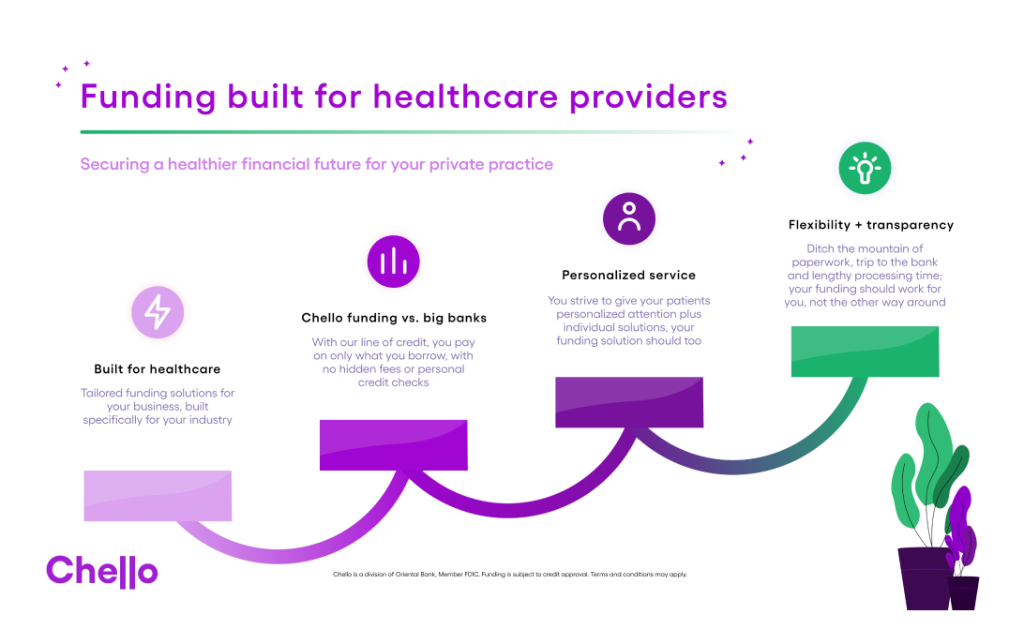

A strong PMS can help medical providers simplify their daily tasks and improve patient care. However, implementing and maintaining a reliable PMS can be costly. If your office is adopting a PMS for the first time or wants to upgrade existing software, a medical business loan from Chello can provide the funds you need.

Learn how an accessible line of credit supports your PMS and improves your financial health.

Why You Need an Up-to-Date PMS

A PMS is an automated software solution designed to simplify and organize the essential functions of a medical practice. These platforms automate tasks like note documentation, insurance, and appointments so providers can see more patients and focus less on administrative work. Most PMS software takes care of the following:

- Scheduling. Manages appointments to prevent double-booking and missed slots, keeping the day organized.

- Billing. Verifies insurance, codes procedures, and submits claims accurately to speed up payments.

- Patient records. Stores all patient data securely in one place for easy access and updates.

- Compliance. Tracks necessary data to help meet regulatory standards like HIPAA, ensuring patient privacy.

Investing in the Future: How a Loan Can Fund Your Practice’s New Software

The right PMS can increase revenue by reducing billing errors and keeping payments on track. But how do you afford new equipment if your practice doesn’t have the funds on hand? Chello’s healthcare practice loans provide flexible funding options for this essential transition.

Depending on the PMS, moving to a new software could cost between 15,000 and 70,000 per provider. For subscription-based EHRs, this often includes a set-up fee, conversion fee, and monthly payment. If you opt for on-site software, you may have expenses like licensing fees, hardware purchases, and installation expenses.

With Chello, there’s no need to take out extra funds—you can borrow the exact amount needed to cover the new PMS and make your practice fully operational. This lets your practice modernize quickly, keeping up with industry standards and improving patient care, all while repaying in easy weekly payments.

Keeping Your System Up-to-Date Without the Financial Strain

Keeping a practice management system up-to-date often involves unexpected costs, from adjustments in subscription fees to essential add-ons and hardware upgrades. Accessible medical practice funding can cover these needs, allowing your practice to address emerging needs and remain secure without straining your budget. Here’s how it can help:

- Subscription fee adjustments. Medical practice funding can help cover unexpected increases in PMS subscription fees, making it easier to maintain premium features that benefit your practice.

- Add-on services. Many PMS providers offer additional tools like patient messaging, appointment reminders, and insurance verification. As your practice grows, a line of credit can help cover these services, supporting your needs as you scale.

- Hardware and security upgrades. Data protection standards change, requiring updates like advanced encryption and multi-factor authentication. A medical practice business loan can cover necessary hardware and software upgrades for on-site PMS systems to keep your practice compliant and secure.

Payment and Claims Integration: Chello’s Funding Engine

Chello’s Funding Engine provides more than just financing—it’s a comprehensive tool designed to support healthcare practices’ financial health. With Chello, your practice accesses integrated cash flow management tools, making it easier to anticipate financial needs, manage claims and payments, and maintain steady cash flow.

| Feature | Benefit to Your Practice | Details |

| 90-Day Cash Flow Projections | Provides detailed cash flow forecasts to help you prepare for upcoming expenses. | - Analyzes historical data and spending patterns - Projects cash flow for 90 days in advance |

| Real-Time Account Integration | Links directly to your checking and savings accounts for live cash tracking. | - Updates in real-time - Combines multiple accounts for a full financial overview |

| Direct Links to Software for Claims & Payments | Simplifies revenue cycle management by syncing claims and payment data. | - Delivers analytics on claims and payments - Helps guide financial decisions with reliable data |

| Spending and Budgeting Insights | Offers spending patterns and budget recommendations tailored to your practice. | - Identifies high-cost areas - Suggests adjustments to optimize cash flow |

| Multi-Factor Financial Analysis | Assesses overall financial health beyond receivables to tailor rates and limits. | - Considers revenue, expenses, and claims - Provides a customized financial profile |

| Data-Driven Funding Recommendations | Advises when to draw funds based on cash flow needs and improving financial stability. | - Identifies optimal funding times - Helps avoid cash flow gaps |

Fuel Practice Growth With Chello

Chello’s loans and credit lines make it simple to set up, maintain, and expand your practice management system without disrupting cash flow. With a medical business loan, you can easily cover setup fees, essential upgrades, and valuable add-ons that keep your practice efficient and responsive to growth.

With flexible funding, you’ll have the resources to prioritize patient care while remaining financially secure. Sign up with Chello today to give your practice the financial foundation it needs to thrive.