How To Secure Medical Business Loans for Doctors

How to Secure Medical Business Loans for Doctors

The medical field is evolving rapidly, and many doctors are looking to expand their practices to meet growing demand. Physician employment is projected to increase by 4% from 2023 to 2033, adding approximately 23,600 new job openings each year. As patient care becomes more complex and technology-driven, securing a medical business loan can provide the financial flexibility you need to achieve your practice goals.

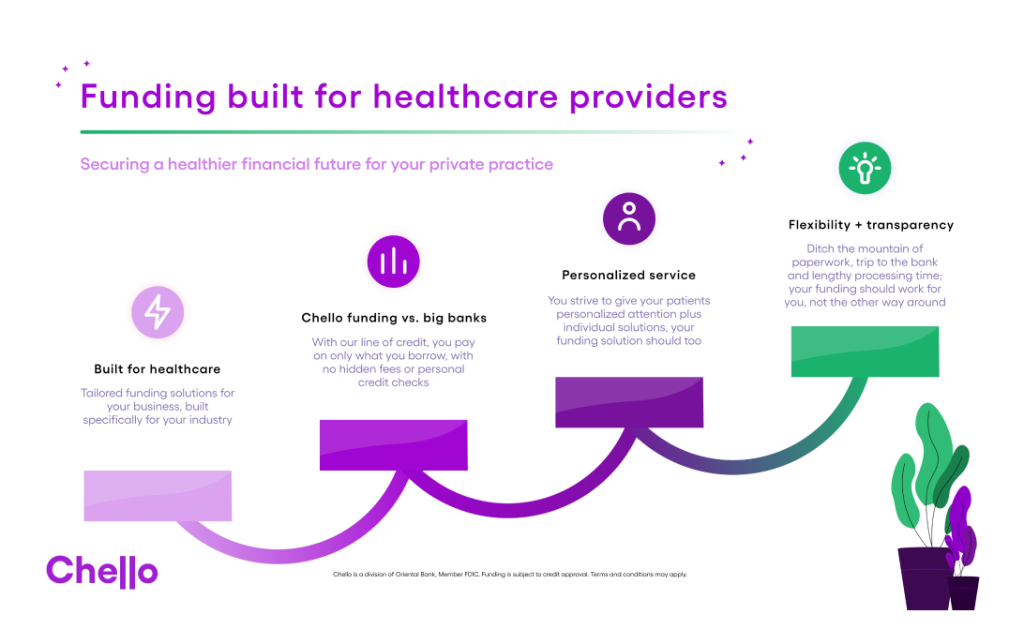

With a specialized lender like Chello, you can access tailored financing solutions designed specifically for healthcare professionals. Whether you’re expanding locations or looking to upgrade your practice with advanced equipment or additional staff, the right loan can support your growth and help you maintain operational excellence.

Learn how to choose a loan provider that meets your specific needs, explore available financing options, and manage your loan effectively so your practice can thrive. Chello offers the tools and support to guide you through each step of the loan process—from understanding loan requirements to offering a convenient repayment plan for your financial health.

What Is a Medical Business Loan?

A medical practice business loan offers financial support designed to meet the unique challenges faced by healthcare professionals. Unlike standard business loans, these loans are tailored to cover specific costs associated with running a medical practice—such as purchasing advanced medical equipment like MRI machines, upgrading electronic health record (EHR) systems, hiring additional staff, or acquiring another practice.

These loans allow doctors to invest in their practice’s growth and continue delivering high-quality care without financial strain. With the right financing, you can manage one-time and ongoing operational costs, ensuring your practice runs smoothly and remains competitive in an increasingly complex healthcare landscape.

Evaluate Your Practice's Financial Needs

Before securing a medical business loan, take the time to assess your practice’s financial needs. Are you looking to expand by leasing or renovating office space? If so, calculate how much capital you’ll need to cover these expenses. For technology upgrades, consider the cost of tools such as MRI machines, telehealth systems, or digital record systems to ensure the loan covers the full purchase price.

Additionally, factor in the recurring operational costs that will impact your financial planning—payroll, malpractice insurance, compliance with healthcare regulations (e.g., HIPAA), utilities, and medical supplies. Properly defining your short-term and long-term financial needs will help you select the loan type and amount that best aligns with your goals.

Explore Available Loan Options

Medical professionals have access to a variety of financing solutions, each designed to meet specific financial goals. Some of the most common healthcare practice loan options include:

- Traditional Term Loans: These loans provide a lump sum upfront, repaid over a fixed period with interest. They’re ideal for large, one-time expenses, such as purchasing real estate, acquiring another practice, or buying expensive medical devices like MRI machines or ultrasound systems.

- SBA 7(a) Loans: These loans are offered through the Small Business Administration and come with low interest rates and flexible terms. They’re commonly used to purchase medical supplies, refinance existing debt, or expand facilities. Their longer repayment terms make them ideal for significant capital investments.

- Equipment Financing: Designed specifically for medical equipment purchases, these loans use the equipment as collateral, which often results in lower interest rates. This option is well-suited for purchasing or leasing medical devices like EHR systems, diagnostic equipment, or surgical tools.

- Business Line of Credit: A line of credit gives you access to funds as needed, up to a set limit. It’s a flexible solution for managing operational costs, unexpected expenses, or cash flow fluctuations. This can be especially helpful when dealing with varying insurance reimbursements or seasonal patient volume.

- Short-Term Loans: If you need immediate funding, short-term loans offer a quick solution but often come with higher interest rates and limited loan amounts. These are typically best suited for covering urgent operational costs or temporary cash flow gaps.

Select the Right Lender

Choosing the right lender is a critical step in securing a loan. Comparing interest rates, fees, and loan terms can have a significant impact on your practice’s financial health. Even a slight difference in interest rates can translate to thousands of dollars in savings over the life of a loan.

For example, borrowing $75,000 over five years at 5% interest would cost around $9,920 in interest. At 8%, however, the total interest jumps to $16,244. Consider whether a fixed or variable interest rate would better suit your needs, especially in light of interest rate trends.

A longer repayment period may lower your payments, but it will increase the overall interest paid. Selecting a lender that offers terms aligned with your practice’s growth trajectory will ensure your financing supports—not hinders—your financial goals.

Chello’s specialized services for healthcare professionals provide competitive rates and loan terms that work with your cash flow needs. We offer weekly repayment terms that can reduce interest accumulation and offer budgeting flexibility to help you achieve long-term objectives.

Prepare Necessary Documentation and Apply

Before applying for a medical business loan, ensure you have all the required documentation ready. Lenders typically request the following:

- Personal and Business Tax Returns: To assess both your personal financial standing and the practice’s profitability.

- Financial Statements: These include your balance sheet and income statement, which help lenders evaluate your practice’s overall financial health and ability to service the loan.

- Business Plan: A well-detailed business plan outlines your practice’s goals, projected income, and growth strategy, which helps lenders gauge the viability of your business expansion or upgrades.

- Proof of Medical Credentials and Licenses: This establishes your legitimacy and professional standing as a healthcare provider.

Once you’ve gathered all the necessary documents, you can apply. Many lenders now offer online applications for convenience. Chello’s Boost Line of Credit simplifies this process, allowing you to complete a quick registration and access your funds in just a few steps. The platform’s seamless integration with healthcare and financial systems provides continuous account management and visibility into your practice’s financial health.

Get the Lending Support You Need To Grow Your Medical Practice

Growing a successful medical practice requires the right financial tools. Whether opening a new location, purchasing advanced medical equipment, or investing in staff training and development, having the right funding option can make all the difference.

As a specialized lender and all-in-one financial platform for healthcare professionals, Chello provides the financing you need and cash flow insights to help your practice thrive. With features like a 90-day cash flow projection tool and seamless integration with your bank accounts, accounting software, and healthcare systems, Chello ensures you can manage your finances while focusing on patient care.

Ready to expand your practice and services? Sign up today and apply for a line of credit that supports both your growth goals.