Specialty Financing: Eye Care

Eye Care Practice Financing

As a seasoned ophthalmologist or optometrist, there is no doubt that you understand the importance of strategic financial management. You’ve been through the ups and downs of opening and/or maintaining a practice and have probably been thrown some financial curveballs along the way.

Whether you're considering expanding your ophthalmology clinic, investing in advanced equipment, pursuing research endeavors as an optometrist, or just preparing for the unexpected, having access to flexible practice financing is crucial. Doing so proactively can ensure your patient care never wavers due to any financial upheavals.

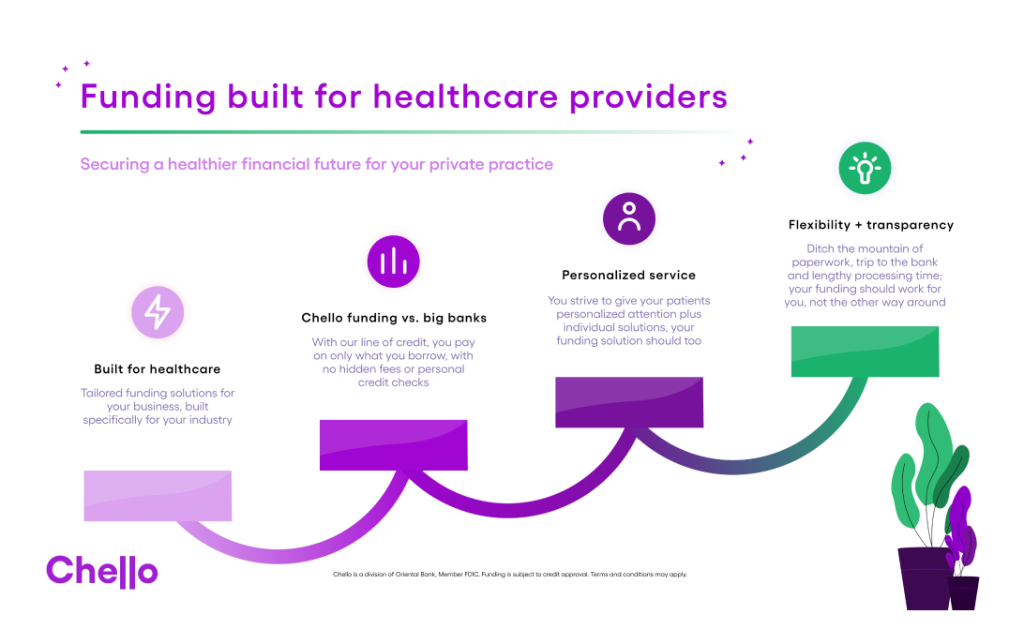

Chello is here to help. Chello’s funding solutions for ophthalmologists and optometrists or anyone in the eye care industry are crafted to address the unique needs of ophthalmologists and ophthalmology practice financing. With years of experience in the healthcare industry, we know enough to not waste your time on unnecessary questions but focus solely on achieving your short-term and long-term goals.

Looking for continued success in your eye care practice? Chello knows how to make that happen.

Reasons an Eye Care Practice May Need Financing

- Purchasing high-resolution optical coherence tomography (OCT) machines, fundus cameras, visual field analyzers, and other cutting-edge equipment. The eye care industry is known for impressive innovations.

- Expanding the array of eyewear options that are available to patients.

- Transitioning to a robust EHR system tailored for ophthalmology streamlining (like patient records, appointment scheduling, and billing).

- Purchasing telehealth software for emergency consultations.

- Recruiting subspecialists to assist with the practice.

FAQs about Eye Care Practice Financing

'You can use Boost as often as you would like, up to the approval limit that was given to you. If there is ever a question of needing more within the line of credit, your relationship manager would be happy to assist.

Good question. Boost ensures that you are covered before, during, and ahead of time. There is no obligation to use the boost funding you are given. It is always there, just in case. Our software helps determine the accurate time for using Boost, if you ever need to use it at all.

Your credit limit is determined by a few different criteria. It has a lot to do with your business revenue and expenses, deposit account balances, claims and payments data, among other factors. The more accounts you link to Chello, the better your limit will be as it gives us more insight.