Rising claim denials have you down? Chello’s here to help pick you up.

The United States has one of the most complex healthcare industries, and it’s getting more complicated each year with insurance claim denials.

This, coupled with widespread staffing shortages, is causing medical practices to see a direct impact on their claim denial rates. In fact, the average claim denial rate has increased by 33% since 2016, and a 2022 survey[1] revealed nearly three out of four respondents say reducing claim denials is their highest priority. To combat rising denial rates, medical practices are spending more time, effort and money – but many are still struggling to see results.

Staffing shortages have played a major role in this increase, which in turn led to increased workloads for the existing staff, fatigue, burnout and potential for errors and incomplete documentation. Overworked staff are challenged to keep up with the administrative tasks necessary to execute accurate claim submissions.

On top of that, COVID resulted in numerous Current Procedural Terminology (CPT) code changes between 2020 and 2022. Incomplete or inaccurate documentation can result in claim denials or delays in payment, creating financial challenges, and even unexpected dips in revenue, for healthcare providers and patients.

What options do healthcare providers have when their staff is already overworked, and they need financial assistance?

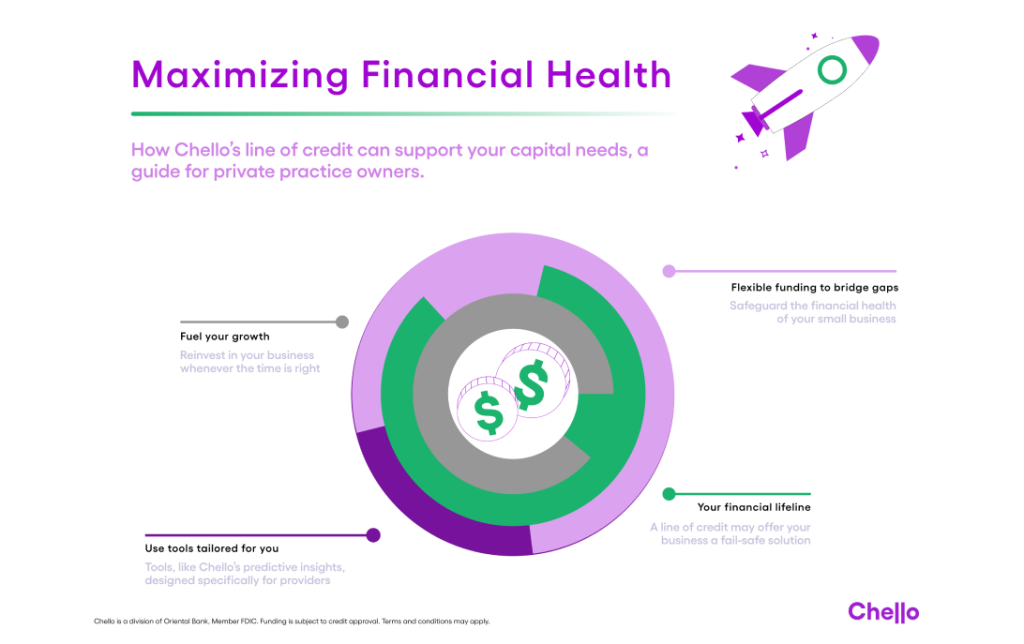

Many practices are turning to technology. Especially software that provides simple and digestible practice insights, claims data and revenue cycle timelines to help staff identify and anticipate potential problem areas. In turn, they can better focus their efforts on the claim categories with the highest denial rates and greatest impacts on the practice’s cash flow. Insights like these can begin to relieve some of the burden on staff and reduce the manual processes many medical practices still rely on.

Healthcare staffing shortages have also affected the timeliness of claim processing. As the demand for care surpasses the available workforce, the time taken to process and review claims increases significantly. These delays result in billions of dollars that are taking longer than anticipated to be reimbursed, if at all, which puts increasing pressure on providers’ cash flow. 73 percent of healthcare professionals[2] said their claims are denied between 5 to 15 percent of the time, and nearly 1 in 3 see declined claims 10 to 15 percent of the time.

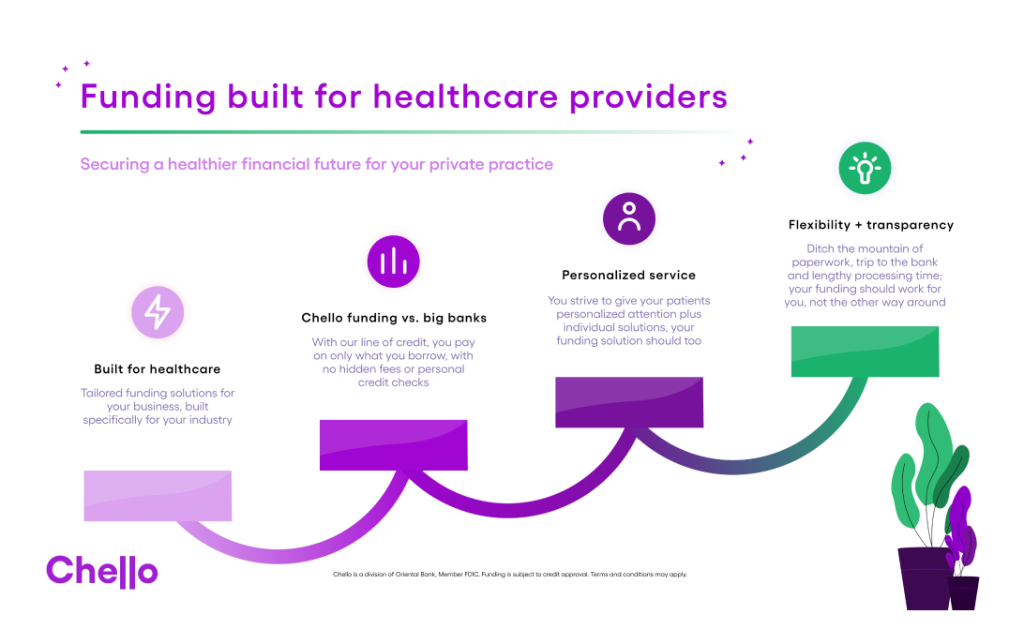

To combat this and the myriad of cash flow challenges that pop up in day to day of practice management, Chello can be a life saver. It provides further clarity into when problems may occur and how to solve for an unexpected dip, or unexpected increase in denials. With Chello’s 90-day forward view, practices can see their expected cash flow and easily access funding, when needed, to cover a cash flow gap until their claims’ payments are received. *

Ultimately, healthcare staffing shortages and unexpected macro-economic events can have a serious impact on claim denial rates, which in turn seriously affects the healthcare community. The increased administrative burden and decreased quality of care resulting from these issues can negatively affect patient outcomes, impact healthcare delivery, and further reinforce the cycle of fatigue and burnout among staff.

Make sure you’re ready.

Learn how Chello can help your practice today, click the button below to get started!

[1] experian_claimssurveypaper_final-9.29.22.pdf

[2] experian_claimssurveypaper_final-9.29.22.pdf

*Subject to credit approval. Terms and conditions may apply. Chello is a division of Oriental Bank, Member FDIC.